One Market, Better Prices: A Simpler Way to Trade Perpetuals

Trading perpetual contracts used to mean navigating separate order books for USD, USDC, and USDG margined contracts. That fragmentation made liquidity shallow and pricing inconsistent. Wider spreads, higher slippage, and poor execution were common, especially for larger trades.

In short, you had to work harder just to get a fair price.

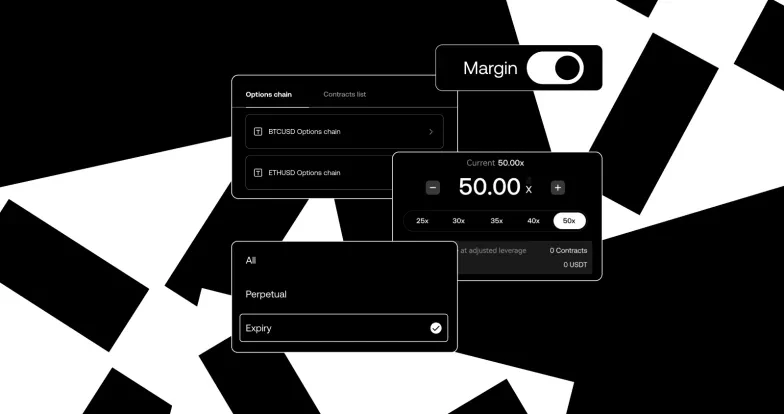

Our Solution: The Power of a Unified Market, brought to Perpetuals

We’ve unified the order books for USD, USDC, and USDG margined perpetuals into a single deep pool of liquidity. With this shared Order book:

All USD-margined contracts now share the same order book.

Liquidity is deeper: Tighter spreads and reduced slippage, even on big trades.

You can use USD, USDC, or USDG as collateral and access the same market.

How This Improves the Trading Experience

This is more than a backend upgrade. It's a direct improvement to the trading experience.Whether you’re managing high-volume trades or just looking for better execution, this upgrade helps you:

Trade with confidence: Know you're getting the best price available.

Save on costs: Tighter spreads mean less money lost, with more accurate pricing on entry and exit market / limit orders

Move faster: A single book means less switching, better decisions, and more time in the market.

When and Where Can You Use It?

We’ve launched Unified Margin Perpetuals for SOLUSD, ETHUSD, and BTCUSD, three of the most liquid markets in crypto.

This marks the beginning of our Unified Perpetual Order Book rollout, designed to offer deeper liquidity, tighter spreads, and more efficient execution across major assets. More markets coming soon.

Where is it available?

Full Support (USDC & USDG): Southeast Asia (Thailand, Indonesia, Vietnam, the Philippines) and Korea.

Global Derivatives Version (USD): The Bahamas and UAE.

Full USDC Rollout: Australia and Seychelles.

Exclusions & Special Models:

Singapore and CIS markets are excluded.

Türkiye KYC-ed users under the entity: OKX TR Kripto Varlık Alım Satım Platformu Anonim Şirketi, are excluded.

Welcome to The New Money App.

© 2025 OKX. Este artículo puede reproducirse o distribuirse en su totalidad, o pueden utilizarse fragmentos de 100 palabras o menos de este artículo, siempre que dicho uso no sea comercial. Cualquier reproducción o distribución del artículo completo debe indicar también claramente lo siguiente: "Este artículo es © 2025 OKX y se utiliza con permiso". Los fragmentos permitidos deben citar el nombre del artículo e incluir su atribución, por ejemplo "Nombre del artículo, [nombre del autor, en su caso], © 2025 OKX". Algunos contenidos pueden generarse o ayudarse a partir de herramientas de inteligencia artificial (IA). No se permiten obras derivadas ni otros usos de este artículo.